Founder of Guizhou Big Data Protection Engineering Security Research Center dies

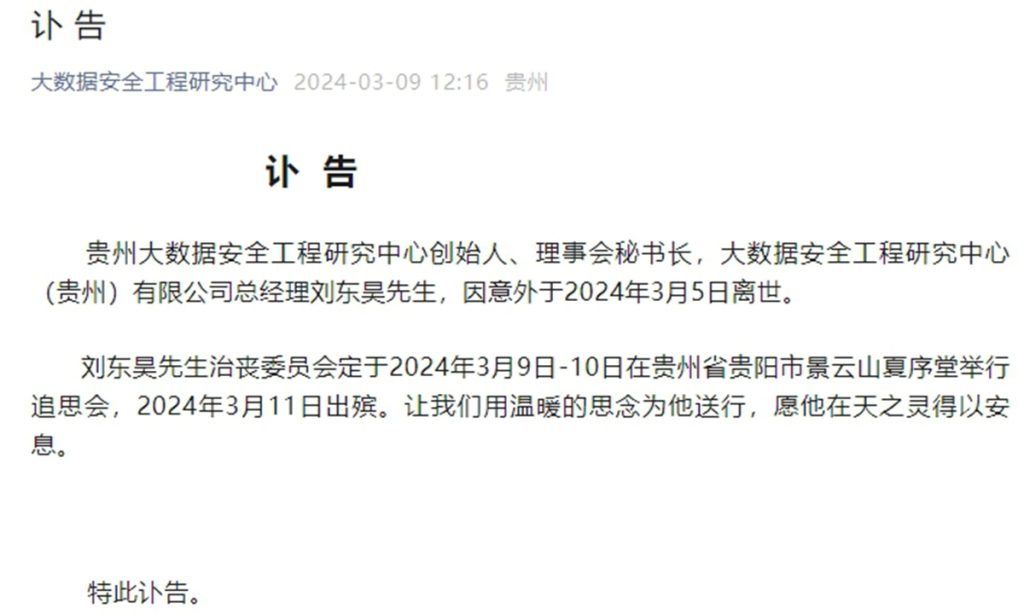

Liu Donghao, the founder of Guizhou Big Data Protection Engineering Security Research Center, died on March 5, the company confirmed through their WeChat account on Saturday.

Liu also served as the secretary-general of the board and the CEO of Big Data Protection Engineering Security Research Center (Guizhou) Co.

The center was established in November 2017, and was a collaborative project initiated by the Guiyang city government and Alibaba Group, focusing on advanced research and development in data security, aiming to pioneer new governance models and industrial practices.

Since 2017, Guizhou has been actively exploring and practicing data security measures. The establishment of the center was a significant step in this endeavor.

Against the backdrop, the center was tasked with conducting Data Security Capability Maturity Model (DSMM) pilot compliance assessments and fostering the data security industry, in line with Guizhou Province's adoption of the national standard cooperation model for DSMM, CRI Online reported in May of 2023.

The center led by Liu, has developed a comprehensive system called DSMM for assessing data security capabilities across industries, which can identify weaknesses and offer strategic solutions through consultation, certification, and training. By focusing on prevention and addressing existing issues, it aims to enhance overall industry security and risk management.

In 2021, the center introduced a pioneering data security governance framework and industry development system based on DSMM principles, national standards, regulations, and assessment methods. This initiative, centered the DSMM national standard, shapes data security governance practices in Guizhou.

Liu stated that the "Guizhou practice" has now been widely implemented across China, setting a model for cities and provinces such as Sichuan, Tianjin, Jiangsu and Chongqing, spanning industries of telecommunications, taxation, government affairs, and manufacturing. This initiative effectively exports the DSMM national standard, driving the industrialization and scaling of national data security standards.

Guizhou has become one of the regions with the largest number of ultra-large data centers in the world, and the growth rate of digital economy has ranked first in China for several years in a row.

The province's growth rate of digital economy has ranked first among Chinese provinces for seven consecutive years, with its added value accounting for about 37 percent of last year's GDP, according to Guizhou Daily.

The provincial government vowed to focus on AI to develop new quality productive forces, aiming to build an internationally competitive computing base in 2024, Jing Yaping, director of the Guizhou Big Data Development Administration said during this year`s National People's Congress, according to chinanews.com.cn.